What is stamp duty?

Stamp duty land tax (SDLT) – to give it its full title – is the Government tax on all property purchases in England* and is payable on all homes priced over £125,000.The amount you pay is dependent on the price of the property you are buying and your circumstances. It is calculated as a percentage of the purchase price, in bands.

How much will I pay?

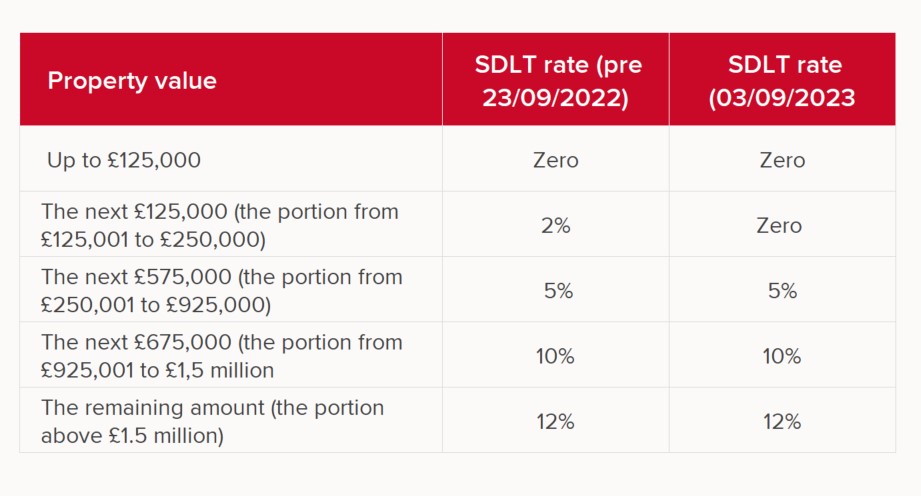

The table below shows how much you will pay per band once the new cuts come into effect from September 23, 2022, compared to the current rates.

For example, on a home priced at £400,000, you will pay SDLT of £7,500 from September 23, 2022 huge saving of £2,500 on previous rates.

If you already own a home and are buying an additional property, you will pay stamp duty at a different rate, while if you are a first-time buyer you will continue to receive a discount. First-time buyers currently do not pay Stamp Duty on the first £425,000 of their home, up from £300,000 and this concession will stay in place. First time buyers’ relief is available on properties up to £625,000, up from £500,000.

How is stamp duty paid?

Stamp duty should be paid to the HMRC via a SDLT return, which will usually be organised by your solicitor or conveyancer if you have one.

It should be paid within 14 days of completion (the date from which you officially own your new home).

Matthew Pratt, Redrow’s CEO, said “If we want a housing market that works for everyone, we need people to be able to move both up and down the ladder.

“In its current form, stamp duty eats into people’s deposits, impacting affordability and ultimately penalising those looking to relocate for work or wanting to downsize as part of retirement plans. Stamp duty needs to be reformed to help the housing market work more effectively and to stimulate more transactions, which will in itself drive tax generation throughout the home buying supply chain of estate agents, solicitors, removals, furnishings etc.

“Whilst we welcome today’s change, we would encourage the Government to consider further steps to reduce the stamp duty burden by reducing the tax bands across all levels, and introducing a lower, flat rate of tax for all homes.” James Holmear, Group sales director for Redrow, said: “In our recent survey, 28% of respondents identified moving costs as the main obstacle to changing homes, ahead of the stress (23%), the logistical challenges (16%) and the emotional implications involved (15%). Stamp duty is one of the largest upfront costs associated with moving home, so reducing this will have a huge impact for homebuyers. In many cases it will help them to move sooner or to put more funds towards their deposit, in turn improving their access to better mortgage rates.”

What does this mean for Wales?

The Welsh Government has announced a higher threshold at which home buyers will need to pay Land Transaction Tax (LTT) on property purchases in Wales. From October 10, 2022, people buying a home up to £225,000 will not have to pay any tax. The rates paid in the higher property price tax bands have increased slightly. From October 10, Welsh house buyers will pay 6% LTT on the portion of their property that is priced between £225,000 and £400,000; 7.5% for the portion between £400,000 and £750,000; and 10% between £750,000 and £1,500,000. For more information visit the Welsh Government website.

* In Wales you must pay Land Transaction Tax (LTT) if you buy a property or land over a certain price threshold. See the Gov.Wales website for more information.